Why a Growing Number of Homeowners Choose To Forgo Home Insurance—and the Nail-Biting Gamble They Face

Illustration by Realtor.com. Source: Getty Images (2)

When Jim Georgatos and his wife bought their home in Coral Gables, FL, in 1989, they were required to purchase homeowners insurance under the terms of their mortgage. And because Coral Gables has historically been prone to hurricanes and other wind events, he was also required to purchase separate windstorm coverage.

He continued to pay for both homeowners and windstorm insurance after paying off his mortgage in 2007, figuring they were sensible safeguards for his property and peace of mind. Then, in 2020, something changed: his windstorm coverage quote shot up—a lot.

“In 2019, we paid about $5,800, and in 2020, we were quoted over $9,000,” says Georgatos. “I know insurance premiums spiked that year, but I think our increase was way above the average increase in South Florida.”

So rather than suck it up and pay, he decided to drop his windstorm insurance coverage.

“We can afford to rebuild without insurance,” he reasons.

Rather than pay these new exorbitant insurance fees every year, he’s decided to gamble on the hope that a hurricane won’t hit his property too hard. At some point, though, he knows his luck could run out, making every hurricane season a nail-biter.

“I would not recommend this approach for everybody,” he admits.

Jim Georgatos

Why more Americans are going without home insurance

Having home insurance is generally seen as a common-sense safeguard, akin to having health insurance; most lenders require homeowners have it to get a mortgage. However, for those who own their homes outright or who otherwise don’t need to get insurance, a growing number are going without.

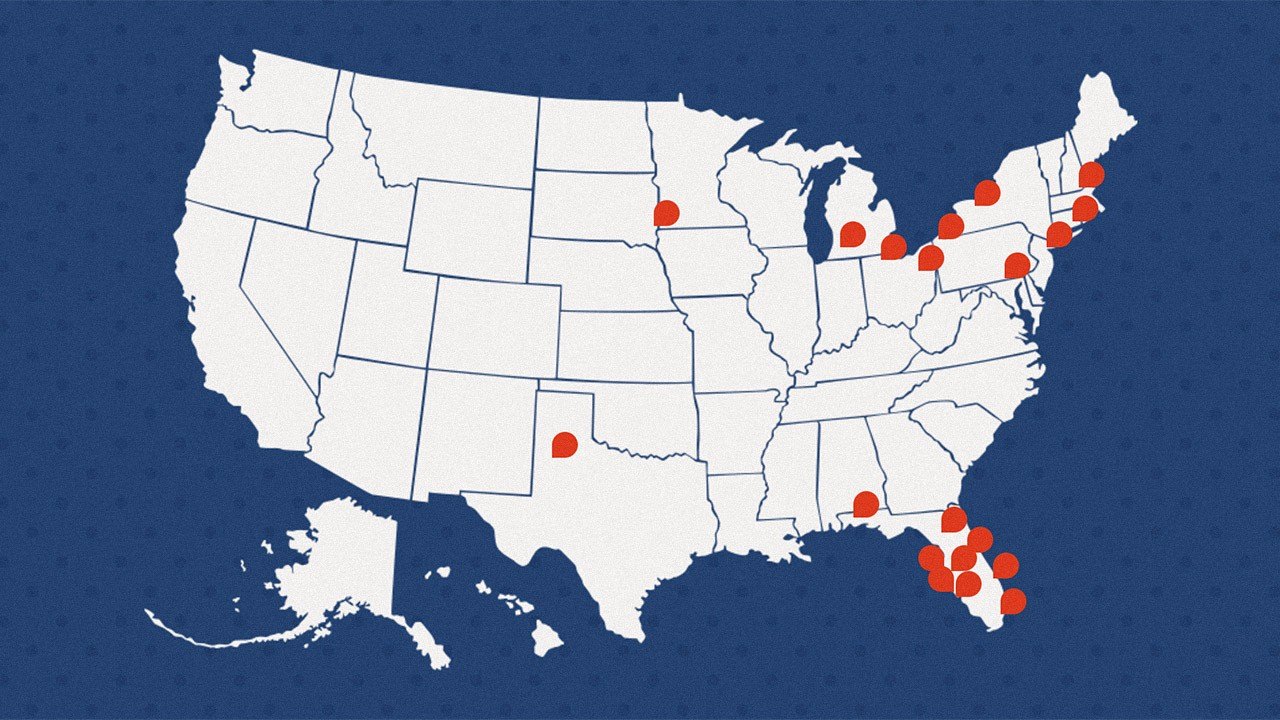

A 2024 Consumer Federation of America study found that around 6 million homeowners—or 7.4% of the homeowner population in the U.S.—have no homeowners insurance, up from 5% in 2019.

In some cases, homeowners are going without insurance because it’s simply no longer offered, due to the increasing frequency of extreme weather events prompting companies to pull out of certain areas. In 2023, both Allstate and State Farm announced they would no longer be taking new homeowners insurance applications in the state of California due to rising construction costs and wildfires.

“Many insurers are stopping coverage in certain places because of the risks associated with climate change and extreme weather,” says Gregg Barrett, CEO of property and insurance company WaterStreet.

Many insurance companies, rather than abandoning risk-prone areas, are jacking up their rates. States disproportionately affected by climate change, like Florida, Louisiana, Colorado, and California, have seen a corresponding steep rise in insurance premiums. In Florida, for example, the average cost of homeowners insurance has tripled over the past four years.

David McNew/Getty Images

But few areas have been completely immune. The average annual cost of homeowners insurance (for a policy with $300,000 in coverage) is now $2,230, up from $1,096 in 2013. In the past year alone, there’s been a 23% increase in average rates.

“Climate change leads to more frequent and severe natural disasters, increasing insurers’ payouts and thus raising premiums to cover these risks,” says Nick Taylor, vice president of mortgage company Better.com. “For homeowners facing these higher costs, opting out of insurance might seem like a way to save money in the short term.”

The changing cost/benefit balance of home insurance

While some homeowners grudgingly pay rising insurance rates, others can’t afford to.

“If companies are able to issue policies, the costs are becoming more than people can afford,” Barrett says. “So we’re seeing many people opt out simply because they can’t afford the cost of the policy where they live, or their insurers are no longer writing policies in those places.”

“Climbing housing and insurance costs have pushed some homeowners to forgo homeowners insurance coverage,” says Realtor.com® senior economist Hannah Jones. “The lack of coverage is especially high, and especially concerning, in areas such as Houston and Miami. Homeowners in these metros face a high risk of property damage due to extreme flood and hurricane events, and are therefore confronted with high insurance costs that may feel untenable to many households.”

And even in cases where homeowners can afford the insurance, some are deciding it’s not worth the cost.

“For really the first time ever, we’re seeing a widespread trend of homeowners doing a cost-to-benefits analysis of insurance and deciding on the uninsured route,” says Elizabeth Dodson, co-founder of homeowner management software HomeZada. “It doesn’t help that today’s policies cover less than the policies of the past, making the choice to cancel seemingly easier than ever.”

The risks of not having home insurance

While homeowners who drop home insurance might be saving money now, they face far more devastating costs down the line if their home gets hit with a storm, fire, and other dangers.

“Opting out of insurance coverage leaves households exposed to unexpected damage and the resulting repair costs,” says Jones.

The Consumer Federation of America report estimates that $1.6 trillion in property is now vulnerable to an array of natural disasters and other calamities. The analysis also found that going without insurance can affect homeowners’ ability to build wealth and financial security over time.

“Being uninsured can foster deeper economic precarity for millions of homeowners across the country, especially those with lower incomes, and is an important contributor to racial inequality,” the study says.

The report found that owning a home without insurance disproportionately affects disadvantaged minorities, affecting 22% of Native American homeowners, 14% of Hispanic homeowners, and 11% of Black homeowners. While 95% of homeowners with properties worth over $150,000 have insurance, that number drops to just 81% for homes valued below this price.

The rising cost of homeowners insurance “puts consumers in a challenging position: bear the increasing financial strain of home insurance or risk the potential for significant financial losses in the event of property damage without it,” says Travis Hodges, the managing director of omnichannel sales and service at digital insurance company VIU by HUB.

For many low-income homeowners who remain uninsured because of climate change and natural disasters, moving is out of the question.

Getty Images

“If you’re just trying to get by, you don’t have the luxury of worrying about climate change,” Dr. Jennifer L. Barkin, executive director of the Center for Rural Health and Health Disparities at the Mercer University School of Medicine in Macon, GA, told the Association for American Medical Colleges in 2023.

Many uninsured homeowners would rather take a gamble on a catastrophic weather event happening, even though it might cost them big in the end.

But Better.com’s Taylor warns: “The cost of repairing or rebuilding a home damaged by such events can be excessively high without insurance coverage. Homeowners without insurance must bear the full financial burden of any property damage or liability claims. This can jeopardize their financial stability and future homeownership prospects.”

HomeZada’s Dodson recommends homeowners consider the risks of going without insurance—and suggests that they shop around to get the best rates.

“Premiums, coverage, and other variables can vary widely from state to state and provider to provider,” she says. “There are still relatively affordable coverage options, even in California and Florida. A good place to start your search is by reaching out to local agents and brokers in your area.”

She also advises that you make sure your insurance coverage matches the climate and weather risk level of your home. Most policies don’t include flood coverage, and you must purchase separate flood insurance if you want coverage.

If you’re searching for a home, you can use the Realtor.com environmental risk score to help determine how climate concerns might factor into your home insurance costs.

Categories

Recent Posts