Homebuyers Reveal How Low Mortgage Rates Must Go Before They Buy a House

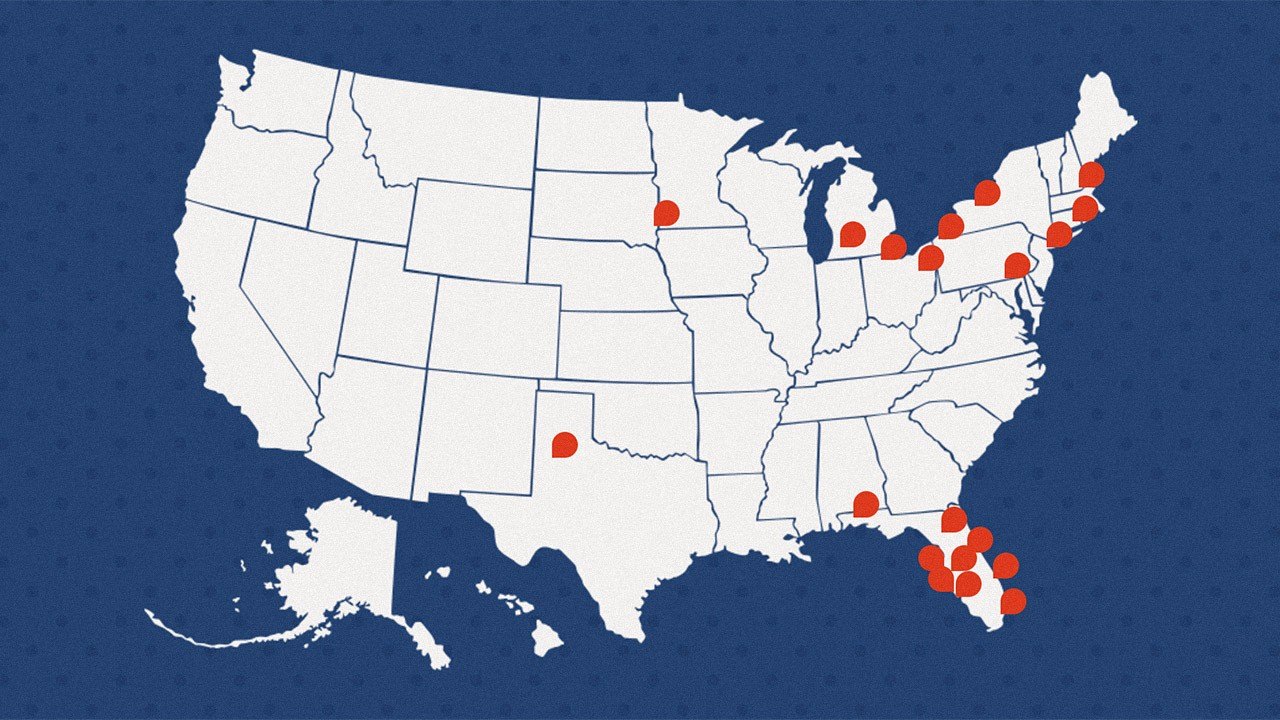

Illustration by Realtor.com. Source: Getty Images

The housing market has been tough in 2024, with stubbornly high mortgage rates keeping many homebuyers on the sidelines.

But in August, a light appeared at the end of this tunnel when rates dropped to yearlong lows—below 6.5% for a 30-year fixed home loan.

And with the Federal Reserve signaling a much awaited interest rate cut in September that could cause mortgage rates to tumble further, many homebuyers are wondering: Is now the time to get out there and start home shopping—or should they wait for even lower rates down the line?

Indeed, the Realtor.com® midyear forecast predicts mortgage rates to fall to 6.3% by the end of the year. This would mean that homebuyers who hold off could stand to save significantly on interest payments. But playing the waiting game comes with risks, and trying to time the market is always a gamble.

Ultimately, how long to wait is a highly personal decision based on each buyer’s circumstances. To highlight these unique perspectives, we found four homebuyers who were willing to share their plans—how low mortgage rates need to go before they get out there, and what they’re doing now to prepare.

In the coming months, we’ll provide regular updates on these homebuyers so you can see how their various strategies pay off, and learn more about how to time your own home search just right.

‘I’ll buy a home once rates fall below 6%’

Homebuyer: Kathi Kendall

Where she’s buying: Scottsdale, AZ, or Gilbert, AZ

Price range: $500,000 to $1 million

How low rates need to go: Below 6%

Her waiting game: Kathi Kendall, 62, who works at a university, wants to sell her current home and buy into a 55-plus community with a golf course and mountain views.

“I am looking for a lifestyle change now that I’m going into retirement and my kids are out of the house,” she says.

Her current home is paid off, with no outstanding mortgage balance. Even so, she explains, “I’m waiting for rates to go down to sell, because lower rates tend to mean higher home prices.”

Kathi Kendall

Once she lists her house, she plans to start looking for a new property immediately, but since she plans to finance her next home purchase, interest rates will continue to affect her choices.

“If the interest rate drops half a point next month, I am going to buy a more modest place,” she says. “If rates drop a full point, I am getting something nicer with a lot of potential to build on its value.”

If Kendall doesn’t find something she loves, however, she plans to wait out the market, put her stuff in storage, and rent a furnished apartment until the time is right.

‘I’m waiting for rates to go below 5%’

Homebuyer: Camille Bradbury

Where she’s buying: Taos, NM

Price range: $300,000 to $450,000

How low rates need to go: 5%

Her waiting game: Camille Bradbury, 39, a director of human resources communications, bought a house in 2021 with a loan at a fixed 3.2% rate. While the rate was great, she purchased right when real estate prices had peaked, paying more than $100,000 over the asking price. To cover this loan, her family gifted her money, which ended up “being messy,” she says.

Now, she’s trying to sell her current home to get out from under her hefty mortgage and pay her family back, boosting her savings by doing side hustles as a consultant. After she sells, she plans to rent until she can afford to get back into the market.

To buy again, Bradbury would like to see rates go below 5%. She realizes she might be waiting for a long time—up to a year or longer—but given the regrets she has with her first home purchase, she wants to proceed with caution.

“I don’t mind waiting,” she says, but adds that she knows not to hold off to the point that a great opportunity passes by.

“The last time, I waited too long and missed out on several great investments in 2020,” she adds.

Camille Bradbury

‘As an investor, I want rates in the low 6% range’

Homebuyer: Yancy Forsythe

Where he’s buying: Kansas City, MO

Price range: $250,000 to $300,000

How low rates need to go: Below 6.25%

His waiting game: Yancy Forsythe, 42, a real estate investor with years of experience buying, selling, flipping, and renting out homes, is hoping to buy his next property soon.

“I’ve been regularly browsing online listings to get a sense of what’s available and to monitor prices,” he says. “I’ve toured a few homes, but I haven’t made any offers yet due to the current rates.”

Although rates are now below 6.5%, he’s “hoping that rates will become more favorable in the near future.”

But he definitely won’t waste much time before getting out there, because he’s “concerned that lower rates will increase competition, making the market even more challenging for us investors.”

Yancy Forsythe

‘With rates now under 6.5%, we’re not waiting any longer’

Homebuyers: Jonathan and Jennifer Ross

Where they’re buying: Fort Worth, TX

Price range: $400,000 to $650,000

How low rates need to go: Below 6.5%

Their waiting game: Attorney Jonathan Ross, 47, and Jennifer Ross, 45, a commercial real estate broker, currently live in San Antonio, TX. The married couple have been considering buying a new home for the past half-year, but only recently got serious about their search once rates dipped below 6.5% in August.

“The reason we’ve decided not to wait any longer for rates to decline as of this month is because it’s likely that home prices will increase when interest rates decrease,” Jonathan explains. “I would rather buy now and refinance later to be sure that I can buy at a reasonable price.”

To make sure a refi is possible later on, they’re making sure to shop carefully for a home loan where the costs and restrictions around refinancing are minimal.

Is waiting for rates to go down a good idea?

Playing the waiting game? You’re certainly not alone.

“I’m working with many sellers who are waiting for rates to come down,” says Sam Fitz-Simon, a real estate agent with Compass in Danville, CA. Many, he says, are homeowners sitting on low-interest mortgages who are waiting “so they can unlock their equity and move up.”

However, Fitz-Simon warns his clients that waiting could end up costing them more.

“The market has proven that increases in interest rates have done little to dampen price increases,” he points out. “The longer people wait, while the amount they can qualify for increases, so do the prices of the homes.”

Plus, the Realtor.com midyear forecast anticipates that falling mortgage rates could put upward pressure on home prices, with list prices anticipated to rise 4.6% by the end of 2024 compared with year-ago levels.

“If lower mortgage rates spark more buyer demand than inventory can keep up with, then prices may climb once again, eliminating the impact of lower rates,” says Realtor.com senior economist Hannah Jones.

Once rates drop, in addition to higher prices, there will be way more competition from other buyers.

“It’s easier to purchase a home with less competition now than to go out into the market later and compete in bidding wars, which typically drive up prices,” says Jason Gelios, a real estate agent with Community Choice Realty in Southeast Michigan.

The typical home spent 50 days on the market in July, so many sellers are still accepting lower offers and offering concessions. Once interest rates start decreasing, sellers will be less likely to do that.

For homebuyers who don’t want to wait, one option to consider is to buy now and refinance later. Homebuyers should also keep in mind that current interest rates are still considered quite low, historically speaking. The 30-year fixed mortgage rate reached a peak of 18.4% in October 1981.

“Many homebuyers are making the mistake of waiting to buy based on the unprecedentedly low interest rates we saw during the [COVID-19] pandemic,” says Lindsay Fanali, a strategic real estate adviser at Real Estate Bees in Wellington, FL. “But it’s highly unlikely we’ll ever see rates go that low again.”

Or look it at another way: “Unless you live with family, you are renting—and rent is 100% interest,” quips Jennifer Vokolek, a real estate agent at Re/Max DFW Associates in Frisco, TX. “There’s always a better financial time to change jobs, get married, have a baby, and even buy a house. Don’t wait on life, live it.”

How homebuyers can prepare while they wait

Even if you’re not ready to buy until interest rates go down, there are steps you can take beforehand, including finding a real estate agent to walk you through the process.

“I’m helping my clients prepare by creating a solid game plan,” says Isiah Denman, a real estate adviser with Spears Group at Compass in Santa Rosa Beach, FL. “First, I ensure they get pre-approved with a lender.”

Once that happens, he goes over the exact process his clients need to follow once they find a home they’re ready to make an offer on.

“That way, they’re ready to act swiftly when the right opportunity arises,” says Denman.

Categories

Recent Posts